Monday, January 31, 2011

India Sectoral Trend Weekly 28 Jan

This week there is a major change in the report. While sectors maintained their trend Nifty has come to Lev Sell on weekly charts on break of 5650 levels.

The main observation is the increasing number of sectors being in Lev Sell from 21 Jan and the reducing number of sectors in Lev Buy/Buy mode. The bullishness if any was in a very few sectors IT and Metal mainly. This was surely a warning of waning breadth in broad stocks.

The sectoral observations:

1. From Sell to Lev Sell changes: BSE 500, Bankex, Cons D, Dollex,BSE Metal, CNX 100, Nifty, CNX Bank.

2. New Sell trigger: BSE Healthcare Index.

3. Lev Buy Indices: BSE IT and CNX IT indices. Though the indices are now in buy mode as of Monday morning.

4. The major money loosers were IT and BSE Teck indices (were in Lev Buy and buy mode) lost 2% each.

P.S. The trend is based on weekly time frame as of Friday closing.

Lev Buy and Lev Sell indicates leverage positioning.

I have included price change with the color for the confirmation.

The main observation is the increasing number of sectors being in Lev Sell from 21 Jan and the reducing number of sectors in Lev Buy/Buy mode. The bullishness if any was in a very few sectors IT and Metal mainly. This was surely a warning of waning breadth in broad stocks.

The sectoral observations:

1. From Sell to Lev Sell changes: BSE 500, Bankex, Cons D, Dollex,BSE Metal, CNX 100, Nifty, CNX Bank.

2. New Sell trigger: BSE Healthcare Index.

3. Lev Buy Indices: BSE IT and CNX IT indices. Though the indices are now in buy mode as of Monday morning.

4. The major money loosers were IT and BSE Teck indices (were in Lev Buy and buy mode) lost 2% each.

P.S. The trend is based on weekly time frame as of Friday closing.

Lev Buy and Lev Sell indicates leverage positioning.

I have included price change with the color for the confirmation.

India: Weekly change in outlook.

Nifty and other broad indices opened in red after last week's fall. We were in bull run what happened?

Well the bull is taking rest and there were ample signs he send our way to let us know that he will be going to sleep and bears will be waking up from hibernation. The sectoral trend along with the State of Market showed that the trend is bearish.

Jokes apart the Nifty formation is very weak after coming into weekly Lev Sell last week. Link here.

Since this being the first weekly Lev sell in this run this can surely do some correction if we break the 5400 levels. The fibonacci support is at 5375 levels and after that the levels if 4800. See the Nifty weekly chart.

What to do here? Should we liquidate the holding?

Well what happens next is anybody's guess but I do feel that the indications are not bullish. One should hold only what shows real growth not just fancy projection from excel.

Well the bull is taking rest and there were ample signs he send our way to let us know that he will be going to sleep and bears will be waking up from hibernation. The sectoral trend along with the State of Market showed that the trend is bearish.

Jokes apart the Nifty formation is very weak after coming into weekly Lev Sell last week. Link here.

Since this being the first weekly Lev sell in this run this can surely do some correction if we break the 5400 levels. The fibonacci support is at 5375 levels and after that the levels if 4800. See the Nifty weekly chart.

What to do here? Should we liquidate the holding?

Well what happens next is anybody's guess but I do feel that the indications are not bullish. One should hold only what shows real growth not just fancy projection from excel.

Friday, January 28, 2011

Nifty X & O chart setting up for more downside

The Point and figure charts are getting more bearish for India. In my last update the index broke the triple bottom which is a bearish sign. Post here.

Now the index has given a bearish catapult breakdown which is a high conviction sell signal. The target comes at 5250 levels.

Attached is the chart.

Now the index has given a bearish catapult breakdown which is a high conviction sell signal. The target comes at 5250 levels.

Attached is the chart.

Nifty @ 5600: Below 200 DMA

Will there be support?

I really do not know how long this level will hold or will there be a bounce.

The index has seen the strongest sell off in the current bull run. Weekly color is Lev Sell for Nifty now, first time since Mar 09.

I have been bearish and the color was Nifty was Lev sell on daily charts. Check y'day morning post.

Whenever Index has broken the 200 DMA in a bull run, either it reverses in a day or two or it makes a new low about 2-4% and then stabilizes. Need to watch the action now.

Color of Major's now. A lot has changed since last time from 24 Jan. Post here.

I really do not know how long this level will hold or will there be a bounce.

The index has seen the strongest sell off in the current bull run. Weekly color is Lev Sell for Nifty now, first time since Mar 09.

I have been bearish and the color was Nifty was Lev sell on daily charts. Check y'day morning post.

Whenever Index has broken the 200 DMA in a bull run, either it reverses in a day or two or it makes a new low about 2-4% and then stabilizes. Need to watch the action now.

Color of Major's now. A lot has changed since last time from 24 Jan. Post here.

Thursday, January 27, 2011

Euro reversal at key fibonacci level

Euro today gave first reversal signal at key level of 1.3700. This levels is very near to key psychological level of 1.3800 for the pair.

The current level is also significant as it is 61.8% retracement of the move from 1.4275 to 1.2870 levels.

Another significant factor to watch is the Dollar Index which has hit the crucial support of 78 levels.

Observe the rolling over of the macd in DXY index. This combined with RSI peak around 55 levels seems bearish now.

Lets watch the action at these crucial levels.

The current level is also significant as it is 61.8% retracement of the move from 1.4275 to 1.2870 levels.

Another significant factor to watch is the Dollar Index which has hit the crucial support of 78 levels.

Observe the rolling over of the macd in DXY index. This combined with RSI peak around 55 levels seems bearish now.

Lets watch the action at these crucial levels.

India Futures diverging from other EM's

Indian markets are completely ignoring what is happening with the other world indices.

US and Europe indices are making new highs for the year with EM's like Taiwan and Korea each day making newer highs.

Our index meanwhile is getting bearish with the research houses going underweight on India. What a sudden change in outlook.

Anyway the color is getting bearish for India.

Nifty is giving whipsaws with no clear direction to trade as every trade is losing one now.

The color as of today is Lev sell on daily which is not changing for last 10 days. The range is getting smaller day by day. Need to watch the 5700 levels now.

Bank Nifty is now in neutral zone with sell mode below 10850 levels.

The only bullish thing as of now is the Index holding the 200 DMA. Thats the last hope for the bulls.

US and Europe indices are making new highs for the year with EM's like Taiwan and Korea each day making newer highs.

Our index meanwhile is getting bearish with the research houses going underweight on India. What a sudden change in outlook.

Anyway the color is getting bearish for India.

Nifty is giving whipsaws with no clear direction to trade as every trade is losing one now.

The color as of today is Lev sell on daily which is not changing for last 10 days. The range is getting smaller day by day. Need to watch the 5700 levels now.

Bank Nifty is now in neutral zone with sell mode below 10850 levels.

The only bullish thing as of now is the Index holding the 200 DMA. Thats the last hope for the bulls.

Wednesday, January 26, 2011

Year 2010 Nifty: System testing the Color code

For long I have been writing about the color of the indices which defines the trend.

I think the best way to know about any strategy is to backtest the strategy. So let us test the Nifty for the color system.

Time frame: Daily for year 2010. Testing only for Longs no Short trade tested.

Buy Condition: Buy color

Sell Condition: Neutral or Sell color

Commissions: 0.10% of trade.

The results

I think the best way to know about any strategy is to backtest the strategy. So let us test the Nifty for the color system.

Time frame: Daily for year 2010. Testing only for Longs no Short trade tested.

Buy Condition: Buy color

Sell Condition: Neutral or Sell color

Commissions: 0.10% of trade.

The results

The system was equal to buy and hold but the profit factor of the trade at 4.7 makes it attractive with only 10 long trades for the year.

Also the maximum draw down for a single trade was about 3% which is reasonable given that we are trading on daily timeframe.

More details later.

Labels:

2010,

Color,

Nifty,

Price Analysis,

Strategy,

System Testing

Tuesday, January 25, 2011

How to interpret the Weekly sectoral trend

Every week I send the weekly trend for the Indian sectors. Last few posts are 21 Jan , 14 Jan. These trends are of medium term time frame traders.

The main points in the report are Current trend with last 2 weeks of trend and the price change this week and last week.

The trend is defined as the color which could be

· Lev Buy --> Leverage Buy: Higher than 125% exposure

· Buy --> Normal Buy Normal exposure to 100%

· Neutral --> No trend On side lines

· Sell --> Bearish Trend Exposure to 100% on sell side

· Lev Sell --> Leverage Sell Trade with > 125% exposure

The Lev Buy and Lev Sell becomes Higher conviction if is repeats for two consecutive week.

The combined trend is called as color of the week for sector.

Example of the recent color view of sectors.

· The changes are few per week as once we get a trend it generally last for more than 2 -3 months. The recent changes are highlighted in yellow.

· The high conviction sell are Infra, Realty, Cap Goods and other indices which have been in Lev Sell mode.

· The high conviction buy are IT and Teck Index which are in Lev buy mode for more than last 3 weeks.

· Also notice the price change for last 2 weeks. This adds as confirmation that the price is also following the asset allocation for sectors.

The main idea of this report is to take stock of various indices on weekly basis and then allocate the money. If someone wants to trade short then the Lev Sell and Sell index compositions are better sell candidates.

This is my way of quantifying trend on weekly basis. Do let me know if we can improve any further.

Color of Major 25 jan

There has some change in the color of Major Movers recently.

Here is the update view:

The main change is the Nifty coming to sell mode in both time frames while Bank Nifty after crossing the 11100 levels is now in Buy mode on daily charts. The hourly trend was reduced buy from 10850 levels itself. Post here.

Nifty is also quite close to the reversal levels of 5900 on daily charts while it will be reduced buy at 5800 levels on hourly charts.

Here is the update view:

The main change is the Nifty coming to sell mode in both time frames while Bank Nifty after crossing the 11100 levels is now in Buy mode on daily charts. The hourly trend was reduced buy from 10850 levels itself. Post here.

Nifty is also quite close to the reversal levels of 5900 on daily charts while it will be reduced buy at 5800 levels on hourly charts.

Labels:

Bank Nifty,

Color,

Nifty,

Reliance

Monday, January 24, 2011

SPX: First signs of bearishness

SPX futures are facing resistance at crucial levels of 1283 levels.

As per earlier post about bull phase entry point the index could have been bot on bullish signs on at 4 hour 50 SMA. The index made a new high when the similar setup occurred in early Jan. Post here.

This is the first time when the futures are showing signs of bearishness as it has not given any bullish candle at the critical levels of 1283.

Though the major trend is still bullish but if the lower top gets followed by lower bottom on break of 1267 then the index can be good sell candidate on rise.

As per earlier post about bull phase entry point the index could have been bot on bullish signs on at 4 hour 50 SMA. The index made a new high when the similar setup occurred in early Jan. Post here.

This is the first time when the futures are showing signs of bearishness as it has not given any bullish candle at the critical levels of 1283.

Though the major trend is still bullish but if the lower top gets followed by lower bottom on break of 1267 then the index can be good sell candidate on rise.

India Sectoral Trend Weekly 21 Jan

The last week has very few changes in the sectoral rotational model.

Major changes and observations are:

1. BSE 100 and Oil & Gas came to Lev sell mode from Sell mode with the Oil & Gas index major looser for the week at -4.5% and Caps Good at -4.5% was the second biggest looser was already in Lev Sell mode.

2. BSE Healthcare is now in Neutral mode after coming to buy mode last week.

3. Other indices downgraded are FMCG and Metal Indices. Both the indices are getting coming down in ratings from last 3 weeks.

4. Major looser among Lev Buy mode was BSE Teck Index while major gainer in Sell mode was Bank Nifty.

P.S. The trend is based on weekly time frame as of Friday closing.

Lev Buy and Lev Sell indicates leverage positioning.

I have included price change with the color for the confirmation.

Major changes and observations are:

1. BSE 100 and Oil & Gas came to Lev sell mode from Sell mode with the Oil & Gas index major looser for the week at -4.5% and Caps Good at -4.5% was the second biggest looser was already in Lev Sell mode.

2. BSE Healthcare is now in Neutral mode after coming to buy mode last week.

3. Other indices downgraded are FMCG and Metal Indices. Both the indices are getting coming down in ratings from last 3 weeks.

4. Major looser among Lev Buy mode was BSE Teck Index while major gainer in Sell mode was Bank Nifty.

P.S. The trend is based on weekly time frame as of Friday closing.

Lev Buy and Lev Sell indicates leverage positioning.

I have included price change with the color for the confirmation.

India Nifty Bank Nifty update 24 Jan

Bank Nifty has recovered and is now above the 10750 levels crucial for bullishness on hourly charts.

The index though is in Sell mode on daily (but will be neutral above 11000 levels) which makes it a reduced buy only above 10750 levels.

Nifty has given a lot of whipsaws last week and the index had a flat close on weekly basis.

The shorts was stopped out on Thursday and Friday with no gains indicating more range bound movement going ahead. The upside resistance is at 5800 levels with support at 5640 levels.

Bank Nifty hourly signal with Nifty channels.

The index though is in Sell mode on daily (but will be neutral above 11000 levels) which makes it a reduced buy only above 10750 levels.

Nifty has given a lot of whipsaws last week and the index had a flat close on weekly basis.

The shorts was stopped out on Thursday and Friday with no gains indicating more range bound movement going ahead. The upside resistance is at 5800 levels with support at 5640 levels.

Bank Nifty hourly signal with Nifty channels.

Labels:

Bank Nifty,

Hourly,

Nifty,

Only Chart

Saturday, January 22, 2011

World Asset Allocation: SPY is the mover

This is a new report I am starting to know how globally money is flowing and to know if there any major changes in asset allocations. Planning to make it a fortnightly issue so that we can get more accurate picture.

The title is apt for this post as US SPX has moved most this year by 2% while the emerging markets moved lower by 2.5%. Are all the $$$'s flowing back?

Funds are withdrawn from Bonds also. The Dollar was -ive and it even broke the old support. The Dollar effect moved up the commodities index CRB as it was slightly +ive.

The title is apt for this post as US SPX has moved most this year by 2% while the emerging markets moved lower by 2.5%. Are all the $$$'s flowing back?

Funds are withdrawn from Bonds also. The Dollar was -ive and it even broke the old support. The Dollar effect moved up the commodities index CRB as it was slightly +ive.

Friday, January 21, 2011

Gold & Platinum: Two different ways

The two precious commodities Gold and Platinum are headed into different directions.

While I was bearish on Gold form Dec (Post here) and the commodity did came to target of 100 DMA (Post here), the Platinum has broke out and is at new highs after breaking of old top made in Nov.

Attached are the charts.

There is a fundamental reason behind this divergence. Since Platinum is mostly used in cars and recently there has been increase of demand of cars in China its import of metal has increased much more and this has lead to breakout in prices.

While I was bearish on Gold form Dec (Post here) and the commodity did came to target of 100 DMA (Post here), the Platinum has broke out and is at new highs after breaking of old top made in Nov.

Attached are the charts.

There is a fundamental reason behind this divergence. Since Platinum is mostly used in cars and recently there has been increase of demand of cars in China its import of metal has increased much more and this has lead to breakout in prices.

Year 2010 Nifty: Price change in a different prespective

This post in about analysing the price change of Nifty Futures foryear 2010 in a different prespective.

I am condisering the available parameters like the OHLC and Volume only. In the next few series I will discuss in detail in next few days to arrive at some trading strategies.

Let me present you with the graph I am gonna discuss.

The Red line is the Nifty chart while the Series 1 and series 2 are built by customizing the data.

The series 1 is the most important among all of the other studies here I gonna present. Why so? Well look at the divergence at important turning points like the Jan Feb sell off then during the May sell and most importantly the big divergence before the sell off in Nov.

The series 2 looks more smooth to trade thenany of the above. True?

Yes, the bell curve of all the series indicates this. See the bell curve of all the series. Special Thanks to Barath who helped me put the numbers into nice curves. (If you need his help let me know)

As you can see both Nifty and Series 1 has fatter tails. Technical term is Kurtosis

This shows more consistency can be there in trading this series rather than Nifty and series 2. (Though some more statistical tests can be done before concluding that.)

The total return of Series 2 are quite similar to Nifty while having lesser volatility. Even the net drawdown is better than Nifty itself.

Que to answer: How the results would be if one trade long/short the series 2 instead of Nifty?

I am condisering the available parameters like the OHLC and Volume only. In the next few series I will discuss in detail in next few days to arrive at some trading strategies.

Let me present you with the graph I am gonna discuss.

The Red line is the Nifty chart while the Series 1 and series 2 are built by customizing the data.

The series 1 is the most important among all of the other studies here I gonna present. Why so? Well look at the divergence at important turning points like the Jan Feb sell off then during the May sell and most importantly the big divergence before the sell off in Nov.

The series 2 looks more smooth to trade thenany of the above. True?

Yes, the bell curve of all the series indicates this. See the bell curve of all the series. Special Thanks to Barath who helped me put the numbers into nice curves. (If you need his help let me know)

As you can see both Nifty and Series 1 has fatter tails. Technical term is Kurtosis

This shows more consistency can be there in trading this series rather than Nifty and series 2. (Though some more statistical tests can be done before concluding that.)

The total return of Series 2 are quite similar to Nifty while having lesser volatility. Even the net drawdown is better than Nifty itself.

Que to answer: How the results would be if one trade long/short the series 2 instead of Nifty?

Futures update 21 Jan

Nifty and Bank Nifty trade was stopped out at 5710 and 10650 levels y'day and now both the indices are in neutral trading zone. The support was perfect when the market moved with volumes at crucial levels of 5640. Though I expected the volumes for the downside but its The Market.

The fact that short trades are not making money for last 3-4 days itself indicates that the short trade could be over for sometime.

Long possibilities for Nifty above the previous high of 5765 and for Bank Nifty above y'days high of 10900 levels.

If you would have looked at y'days Nifty channel chart there was sideways channel formation for this week on hourly chart. This happens when the Index is at support levels and making base for a large move.

The fact that short trades are not making money for last 3-4 days itself indicates that the short trade could be over for sometime.

Long possibilities for Nifty above the previous high of 5765 and for Bank Nifty above y'days high of 10900 levels.

If you would have looked at y'days Nifty channel chart there was sideways channel formation for this week on hourly chart. This happens when the Index is at support levels and making base for a large move.

Thursday, January 20, 2011

Bank Nifty: System Testing Trend Defining Line

Last month I wrote about a simple concept of buying and selling based on a buying and selling on cross of a simple trend line. Post here.

Then I tested the Nifty daily data of last 15 years and the system was outperforming the buy and hold. Post here.

Today I am testing the same concept for Bank Nifty on weekly charts. The main reason I am testing on weekly instead of daily charts is that the Bank Nifty being a high beta index has more whipsaws on daily charts and the test conditions being very simple it generates a lot of trades some even by just 2 points lower close.

Also there are always different system performing well on different timeframes and we should always trade them in that very timeframe for maximum advantage.

Please see this post as an endeavor to quantifying some technical strategies and then optimize them for better trading results.

Lets look at the results:

Buy & Hold out performance: 54%

Profit Factor (Profit/ Loss): 5.3

Absolute Drawdown: 513 points

Time frame: Daily for last 10 years on Bank Nifty spot.

Buy Condition: Close above the TDL.

Sell Condition: Close below TDL

Short Condition: Close below TDL

Profit Book Condition: Close above the TDL.

Commissions: 0.10% of trade.

Trade Entry: Buy/Sell on next open bar i.e. if signal is generated before today's close then buy/sell tomorrow open. This is to have a realistic results and avoids preempting the signal though we loose a lot by waiting for next candle.

As can be seen these are very simple rules to trade.

Output

Equity curve is attached.

Then I tested the Nifty daily data of last 15 years and the system was outperforming the buy and hold. Post here.

Today I am testing the same concept for Bank Nifty on weekly charts. The main reason I am testing on weekly instead of daily charts is that the Bank Nifty being a high beta index has more whipsaws on daily charts and the test conditions being very simple it generates a lot of trades some even by just 2 points lower close.

Also there are always different system performing well on different timeframes and we should always trade them in that very timeframe for maximum advantage.

Please see this post as an endeavor to quantifying some technical strategies and then optimize them for better trading results.

Lets look at the results:

Buy & Hold out performance: 54%

Profit Factor (Profit/ Loss): 5.3

Absolute Drawdown: 513 points

Time frame: Daily for last 10 years on Bank Nifty spot.

Buy Condition: Close above the TDL.

Sell Condition: Close below TDL

Short Condition: Close below TDL

Profit Book Condition: Close above the TDL.

Commissions: 0.10% of trade.

Trade Entry: Buy/Sell on next open bar i.e. if signal is generated before today's close then buy/sell tomorrow open. This is to have a realistic results and avoids preempting the signal though we loose a lot by waiting for next candle.

As can be seen these are very simple rules to trade.

Output

Equity curve is attached.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Labels:

Bank Nifty,

System Testing,

Trend line System

India Futures update 20 Jan

Nifty and Bank Nifty gave a sell signal y'day and they gapped down today.

This sell signal assumes more significance as the Daily signal for both the indices is in sell mode.

For Nifty the support is at 5650 and Bank Nifty at 10450 levels. Since Nifty has not broken the 5650 levels any close below that level today will be a bearish sign and more selling can follow on.

Watch the volumes at 5650 as last two days were of low volumes rise so if volume increases today it can be of great significance otherwise we can see one more shallow rise in Indices.

Reliance: The stock was in sell color from 17 Jan. Post here.

Hourly charts:

This sell signal assumes more significance as the Daily signal for both the indices is in sell mode.

For Nifty the support is at 5650 and Bank Nifty at 10450 levels. Since Nifty has not broken the 5650 levels any close below that level today will be a bearish sign and more selling can follow on.

Watch the volumes at 5650 as last two days were of low volumes rise so if volume increases today it can be of great significance otherwise we can see one more shallow rise in Indices.

Reliance: The stock was in sell color from 17 Jan. Post here.

Hourly charts:

Labels:

Bank Nifty,

Hourly,

Nifty,

Trading

Wednesday, January 19, 2011

SPX : Magic of 10 DMA in Bull phase

The chart shows the power of 10 SMA in bull phase. Every decline is a buy. But how long?

Just the chart.

Just the chart.

Technical Analysis and Forex

Forex is the biggest and most liquid market in the world with some estimate putting it to be a $3,700bn-a-day volumes. The participation in this market is also quite high the low marigins at 1% attracts everyone from student to most sophisticated Algo traders.

Well my concern is Quant and Technical strategies so lets me update you about that correlation here.

The subject is a paper by St. Louis Branch of the Federal Reserve Bank that the simple Technical Strategies are not working that well in forex markets. Link here.

Not quite surprising given that everyone can read and trade with simple strategies just by reading some books and blogs. And when everyone follows the same path it leads to cliff not to throne.

The paper at the same time mentions that the complex strategies are still profitable.

The complex strategies are however really complex like Neural Network trading, Cross currency pairs, Genetic Algorithms and much more.

Well my concern is Quant and Technical strategies so lets me update you about that correlation here.

The subject is a paper by St. Louis Branch of the Federal Reserve Bank that the simple Technical Strategies are not working that well in forex markets. Link here.

Not quite surprising given that everyone can read and trade with simple strategies just by reading some books and blogs. And when everyone follows the same path it leads to cliff not to throne.

The paper at the same time mentions that the complex strategies are still profitable.

The complex strategies are however really complex like Neural Network trading, Cross currency pairs, Genetic Algorithms and much more.

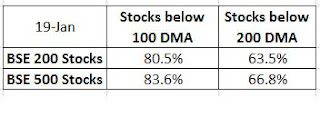

State of market 19 Jan update;Bearishness at extreme

I have not updated about the State of Market for quite some time now. The last report was bang on time as the stocks did moved lower after the update on Jan 10. Post here.

The bearishness now is at extreme as a very high %age of the stocks are in sell mode. Table below:

The bearishness now is at extreme as a very high %age of the stocks are in sell mode. Table below:

The ratio of buy and sell %ages are at extreme for last 6 months which shows deep oversold levels in the not only for the index but also for the breadth of the market.

We can for sure see some rally from here which can correct this over sold levels.

Taking stock of the market breadth from BSE 200 and BSE 500 stocks.

I tried to calculate the number of stocks below 100 and 200 DMA for the above indices. The results:

Stocks of BSE 500 below 100 DMA is more than BSE 200 Index for both the 100 and 200 DMA count. This indicates the sell off was more in midcap & small cap stocks.

Worth noting is the # of stocks below 200 DMA which is higher than 50% while Nifty has still not broken the 200 DMA. What it means? As per my understanding it shows that the market can bounce very strongly as Nifty is staying above the 200 DMA and this can sure trigger some buying in mid cap stocks.

Do write back with ur interpretions.

Labels:

BSE 200,

BSE 500,

State of Market,

Stocks

Nifty Bank Nifty futures 19 Jan

The hourly charts of the futures are in neutral mode. The opening was expected to be good but what matters for bullishness is the strength above y'days high of 5745 and 10700 levels as mentioned here.

On the downside since there is higher bottom formation can look for support at 5650 and 10450 levels. Any break of that will be trigger bearishness as Daily charts are still in sell mode.

On the downside since there is higher bottom formation can look for support at 5650 and 10450 levels. Any break of that will be trigger bearishness as Daily charts are still in sell mode.

Tuesday, January 18, 2011

Nifty futures: Narrowing daily range

Nifty futures had the narrowest range today in the last 7 days. The index had narrowest range y'day also at 76 points. Today the range was 69 points.

The index gave a higher close above y'days high with a slight upside gap.

Any continuation above 5742 (todays high) is a bullish sign as this particular trade setup is based on the narrow range of last 7 days.

The index gave a higher close above y'days high with a slight upside gap.

Any continuation above 5742 (todays high) is a bullish sign as this particular trade setup is based on the narrow range of last 7 days.

Nifty Bank Nifty update 18 Jan

Y'day the futures were in a tight range with indices at levels where the declines get over in Bull phase.

Trading can be volatile here so any new postions in profit should be partially booked as we hit supports/resistances.

The high of y'day at 5704 can be regarded as first resistance and 75% of potions should be booked at 5710 with closure of shorts at 5750.

For Bank Nifty the first profit booking level is 10600 and then shorts closure levels is 10750.

Generally the last leg of any move is the most difficult to capture and profit as it is swift and volatile. And we are seeing high volatility with long wicks on candles for last 2-3 days.

Trading can be volatile here so any new postions in profit should be partially booked as we hit supports/resistances.

The high of y'day at 5704 can be regarded as first resistance and 75% of potions should be booked at 5710 with closure of shorts at 5750.

For Bank Nifty the first profit booking level is 10600 and then shorts closure levels is 10750.

Generally the last leg of any move is the most difficult to capture and profit as it is swift and volatile. And we are seeing high volatility with long wicks on candles for last 2-3 days.

Monday, January 17, 2011

Nifty: The X & O graph

X& O the popular symbols of point & figure charts.

The point & figure may be an old technique to analsyse but they are the best of all.

It just shows what matters the most: Trend whenever the price change is meaningful. Rest is just noise.

I did not know if one has noticed or not but Nifty has now given a sell signal in P&F charts.

In the chart it has broken the triple bottom.

Though the long term trend line is intact the intermediate trend is bearish.

The chart.

The point & figure may be an old technique to analsyse but they are the best of all.

It just shows what matters the most: Trend whenever the price change is meaningful. Rest is just noise.

I did not know if one has noticed or not but Nifty has now given a sell signal in P&F charts.

In the chart it has broken the triple bottom.

Though the long term trend line is intact the intermediate trend is bearish.

The chart.

India Sectoral Trend Weekly 14 Jan

Here is the weekly trend analysis report. It got delayed due to some technical issues in data.

P.S. The trend is based on weekly time frame as of Friday 14th closing.

Lev Buy and Lev Sell indicates leverage positioning.

I have included price change with the color for the confirmation.

The major changes from the last report (post here 7th Jan) are:

1. CNX IT and BSE Healthcare got downgraded from Lev Buy to Buy mode.

2. BSE Cap Goods and Nifty Junior are now in Lev Sell mode from Sell mode.

3. Major losers CNX Infra, CNS Realty, BSE Cap goods, Oil & Gas, Realty, Bank Nifty were in Lev Sell mode.

4. Only CNX IT got sold off 3% while still being in buy mode. It is the major looser in the buy mode and the main reason was earnings disappointment.

5. Indices in Lev buy mode FMCG, BSE IT, Metal, Teck had only -0.2% cumulative change.

Here is the color view.

P.S. The trend is based on weekly time frame as of Friday 14th closing.

Lev Buy and Lev Sell indicates leverage positioning.

I have included price change with the color for the confirmation.

The major changes from the last report (post here 7th Jan) are:

1. CNX IT and BSE Healthcare got downgraded from Lev Buy to Buy mode.

2. BSE Cap Goods and Nifty Junior are now in Lev Sell mode from Sell mode.

3. Major losers CNX Infra, CNS Realty, BSE Cap goods, Oil & Gas, Realty, Bank Nifty were in Lev Sell mode.

4. Only CNX IT got sold off 3% while still being in buy mode. It is the major looser in the buy mode and the main reason was earnings disappointment.

5. Indices in Lev buy mode FMCG, BSE IT, Metal, Teck had only -0.2% cumulative change.

Here is the color view.

Color of Major Movers 17 Jan

The major movers continues to be in Sell mode from last week. Last week's post here.

The main change is Nifty and Ban Nifty came to daily Lev Sell mode on break of 5850 and 11000 levels.

The main change is Nifty and Ban Nifty came to daily Lev Sell mode on break of 5850 and 11000 levels.

This time let me also post the Nifty and Bank Nifty daily charts.

The chart is does not looks that good as I made it in a hurry. Will do a good job next time.

Labels:

Bank Nifty,

Color,

Nifty,

Reliance

Saturday, January 15, 2011

India ETF's below 200 DMA with India underperforming in Emerging Markets

Indian ETF's MSCI India ETN (IPN) and Wisdom Tree India (EPI) opened and closed below 200 SMA.

This matters a lot as recent flows and outflows has been mostly from ETF's. If money is moving out of the then it will have sell off in India. Closing below 200 DMA is a bearish factor.

The Wisdom Tree Fund is $1.5bn+ fund and MSCI India is $1bn fund. More Info here.

Attached are the charts.

India has been under performing other emerging market indices specially China which is worrisome if this trend continues further.

Worth mentioning is the fact that the China has been underperforming due to Inflation (leading to rates increase) and similiar problem is now in India.

Other market having similar problems is Indonesia which is also one of the underperformer.

This matters a lot as recent flows and outflows has been mostly from ETF's. If money is moving out of the then it will have sell off in India. Closing below 200 DMA is a bearish factor.

The Wisdom Tree Fund is $1.5bn+ fund and MSCI India is $1bn fund. More Info here.

Attached are the charts.

India has been under performing other emerging market indices specially China which is worrisome if this trend continues further.

Worth mentioning is the fact that the China has been underperforming due to Inflation (leading to rates increase) and similiar problem is now in India.

Other market having similar problems is Indonesia which is also one of the underperformer.

Friday, January 14, 2011

Nifty Market Profile and Volumes: Stepping down on price ladder

Nifty future Market Profile picture is like stepping down a price ladder.

The market profile on breaking the range has closed down the lower range for 3 days and on one day it closed above the value area.

The volume action is suggesting heavy auctions at the 5750 range and then at the 5830 levels.

The index even closing below the last few failed auctions at 5750 levels and today closing below 5750 levels shows more selling to trigger here.

The market profile on breaking the range has closed down the lower range for 3 days and on one day it closed above the value area.

The volume action is suggesting heavy auctions at the 5750 range and then at the 5830 levels.

The index even closing below the last few failed auctions at 5750 levels and today closing below 5750 levels shows more selling to trigger here.

What a fall In Nifty

What a fall in Nifty and other sectoral indices.

Well the system was in Lev Sell mode for Nifty and Bank Nifty futures.

Here is the list of posts where Sell was signal was generated most recent being today morning where the sell was triggered at 5820 levels for Nifty and at break of 11000 for Bank Nifty.

Hourly Sell signal Nifty Bank Nifty hourly update 14 Jan posted today.

Daily Sell signal Color of market: India Futures still on weak footings posted y'day.

Please spread the msg.

Well the system was in Lev Sell mode for Nifty and Bank Nifty futures.

Here is the list of posts where Sell was signal was generated most recent being today morning where the sell was triggered at 5820 levels for Nifty and at break of 11000 for Bank Nifty.

Hourly Sell signal Nifty Bank Nifty hourly update 14 Jan posted today.

Daily Sell signal Color of market: India Futures still on weak footings posted y'day.

Please spread the msg.

Nifty Bank Nifty hourly update 14 Jan

Today for the update I am attaching the hourly charts which need to be seen with the daily color update I posted y'day.

See the color change and being in daily sell mode the shorts started.

See the color change and being in daily sell mode the shorts started.

Thursday, January 13, 2011

Quantifying: Nifty and Bollinger Bands Strategy

Quantifying: Nifty and Bollinger Bands

Bollinger bands are one of the most popular indicators for the traders.

The bands serve as volatility indicator and can be used for breakouts and in option trading for predicting volatility expansion and contraction.

I assume everyone here would know the theory part so let me skip it.

One of the use of Bollinger bands is to long on close above the upper bands and short on close below the lower band. That’s the easiest trade suggested by John Bollinger also who is the founder of the bands.

Let’s see how that strategy worked for the Nifty.

Seeing the chart above the best way to trade was to short on close above the bands. Totally reverse of above strategy. That’s quite mind boggling.

Now I will try to quantify why such a thing has happened and when the simple strategy works and when not.

Since I am not well with excel can some one please help me with some of the number crunching, backtesting and building a macro so that it can be used for other indices/stocks also.

Anyway the initial test suggests the following observations:

1. Buying on close above the upper band has a real good success rate in Bull phase but the bullish candles at the lower band has even much higher success rate.But with some additional filter it improves a lot.

2. Two successive closes is the best indicator to buy. But there is a big catch here.

3. If the strategy fails twice then it is a bearish indicator suggesting change in trend. Best example is the recent fall. But I feel that there was a warning signal even in December suggesting a fall.

The above points I feel is just only a few. If anyone knows excel coding well we can probe further and then unravel the mystery to make the above strategy one of good strategy to trade with.

Color of market: India Futures still on weak footings

A lot has changed is last 4 days after the last report on the Color of the Major players.

The following color matters a lot as it provides the positioning that is fed into the hourly charts for the trading purpose. These results can be used as standalone basis for the major moves to play.

Do compare this with the last post on the market major color here.

Nifty has come to sell mode on breach of 5980 on weekly.

Reliance closed below the key levels for 1030 and is now in sell mode.

CNX IT and closed below the 7200 levels and now the reversal to buy level is 7300.

Bank Nifty has been consistently in sell mode but now the levels are reduced to 11300 levels.

The following color matters a lot as it provides the positioning that is fed into the hourly charts for the trading purpose. These results can be used as standalone basis for the major moves to play.

Do compare this with the last post on the market major color here.

Nifty has come to sell mode on breach of 5980 on weekly.

Reliance closed below the key levels for 1030 and is now in sell mode.

CNX IT and closed below the 7200 levels and now the reversal to buy level is 7300.

Bank Nifty has been consistently in sell mode but now the levels are reduced to 11300 levels.

Labels:

Bank Nifty,

Color,

Nifty,

Reliance

Wednesday, January 12, 2011

US Sectoral Trend: Financials all the way

XLF has outperformed all the other sectors in last 30 days.

The ETF was lagging for last 6 months and was worst performer during that period.

The defensive sectors such as Consumer Staples, Utilities and Healthcare were –ive.

Continuous improvement in the ISM Manufacturing Index has led to new highs for Industrial ETF as well.

The overall picture shows the improvement in the economy.

Nifty Bank Nifty futures update 12 Jan

Nifty and Bank Nifty on hourly chart have given the short covering signals at 10900 and 5800 levels.

There has been multiple divergences on the charts with daily candle showing some support at the trendline combined with seesaw movement on intraday basis suggests that the bears can no longer control the market at these levels.

The fact that the market failed to break the previous lows on the bad news itself shows bullishness at the low levels.

Covered remaining shorts at the above levels. Right now the trading can be more range bound and will be volatile.

Should go long from here:

Well thats very much debatable. Going long is purely a risk at these levels.

Can buy some OTM calls as I feel the next resistance is at 5925 levels as mentioned in this post y'day.

There has been multiple divergences on the charts with daily candle showing some support at the trendline combined with seesaw movement on intraday basis suggests that the bears can no longer control the market at these levels.

The fact that the market failed to break the previous lows on the bad news itself shows bullishness at the low levels.

Covered remaining shorts at the above levels. Right now the trading can be more range bound and will be volatile.

Should go long from here:

Well thats very much debatable. Going long is purely a risk at these levels.

Can buy some OTM calls as I feel the next resistance is at 5925 levels as mentioned in this post y'day.

Tuesday, January 11, 2011

SPX Showing slowdown in momentum

SPX futures at 1266 are showing signs of weakening momentum.

The index was a buy when key support of 50 SMA in 4 Hr chart was hit. Read Trade Example: Bull Phase Entry points.

The index made a new high after the post at 1276 levels.

Now the index hit the 50 SMA in 4 Hr charts again twice in last 2 days which I view is a bearish sign. This is testing of support levels too fast which indicates selling pressure.

The index did bounced after exhibiting a doji below the support followed next by a bullish candle.

But this time the index is hesitating at the 20 SMA which is the mid band.

Also the bands are contracting with macd having divergence at new tops.

How to trade: Thats the most important question.

I will not short out rightly as the signs are of range not of bearishness. And since the index is in bull phase shorts have a very low winning rate.

Long if the index moves above the current bearish candle and gives a close above the 20 SMA with profits to be booked at 1275 levels OR long at the lower band when there are bullish signs like doji or long lower wick.

The index was a buy when key support of 50 SMA in 4 Hr chart was hit. Read Trade Example: Bull Phase Entry points.

The index made a new high after the post at 1276 levels.

Now the index hit the 50 SMA in 4 Hr charts again twice in last 2 days which I view is a bearish sign. This is testing of support levels too fast which indicates selling pressure.

The index did bounced after exhibiting a doji below the support followed next by a bullish candle.

But this time the index is hesitating at the 20 SMA which is the mid band.

Also the bands are contracting with macd having divergence at new tops.

How to trade: Thats the most important question.

I will not short out rightly as the signs are of range not of bearishness. And since the index is in bull phase shorts have a very low winning rate.

Long if the index moves above the current bearish candle and gives a close above the 20 SMA with profits to be booked at 1275 levels OR long at the lower band when there are bullish signs like doji or long lower wick.

Subscribe to:

Comments (Atom)