The Nifty index has rallied 8% this month and has outperformed the regional peers.

The move has been limited mainly to large cap namely the Nifty and BSE 200 indices.

Attached is the screenshot of the Indices showing Nifty outperforming all the other indices.

This is the same kind of move we saw in Sep 2010 where the Nifty index outperformed the other broader indices.

Analyzing the BSE 500 stocks w.r.t Nifty.

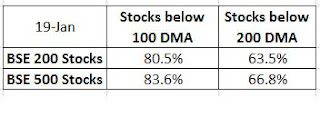

Nifty has crossed the 200 DMA while BSE 500 index is still below the 200 DMA.

There is pickup in volumes recently in BSE500 index which is above average. For any full fledged rally we need the volumes to return to broader market.

The move has been limited mainly to large cap namely the Nifty and BSE 200 indices.

Attached is the screenshot of the Indices showing Nifty outperforming all the other indices.

This is the same kind of move we saw in Sep 2010 where the Nifty index outperformed the other broader indices.

Analyzing the BSE 500 stocks w.r.t Nifty.

Nifty has crossed the 200 DMA while BSE 500 index is still below the 200 DMA.

There are 26% of the BSE 500 stock above 200 DMA which shows the poor breadth as of now.

The Bullish MA setup is in only 15% of the BSE 500 stocks till now.

There is pickup in volumes recently in BSE500 index which is above average. For any full fledged rally we need the volumes to return to broader market.